5 Reasons Why Gen Z Singaporeans are Rewriting the Consumer Playbook

Our latest SensingSG data (Q2 2025) reveals some interesting figures, depicting high national optimism, personal financial sentiment and economic outlook positivity in Singapore. However, these headline statistics get even more interesting when we take a magnifying glass to the demographic chiefly driving them – Singaporeans under 30 (who we’ll call ‘Gen Z’).

Their standout levels of optimism, sentiment on brand trust, and attitudes towards experiences and engagement set them apart from other age groups and are indicative of why they could be rewriting the consumer playbook. Here, we explore 5 ways in which they could do so.

1. Gen Z Is Bullish on the Economy, their Finances and the Future

According to our data, 64% of under 30s are positive about Singapore’s broad economic outlook in the next year, higher than the 55% average for other age groups, with the disparity growing wider with age. When it comes to personal finances, the trend continues, with 70% of under 30s expecting to be financially better off a year from now, compared to just 59% across the board. Similarly, we see the same story play out when it comes to optimism on overall national direction – a staggering 92% of under 30s in Singapore think the country is heading in the right direction, the highest proportion compared to other age groups, averaged at 89%, as well as the highest level on record since we started tracking the metric 2 years ago.

Why this matters: Younger Singaporeans aren’t just hopeful, they’re ready to act on it. High economic confidence among Gen Zs often translates into greater spending willingness, lower savings inertia, and a stronger appetite for lifestyle upgrades. For brands, this signals a strategic opening: tap into the momentum of an optimistic cohort that’s primed to spend, experiment, and engage - even when older consumers remain cautious.

2. Global Trade Tremors Don’t Worry Gen Z

In addition to their economic and financial confidence being high, the positive sentiment of young Singaporeans remains largely firm in the face of geopolitical headwinds like Trump’s tariffs. Just under half of young Singaporeans still think positively of American products and services in light of the tariffs, compared to fewer than 1 in 3 for their older counterparts. What’s more, under 30s also prefer American brands over Chinese ones across half of product categories we surveyed, compared to just 30% of all other age groups. This suggests that trade tensions and volatile geopolitical situations do not affect young people’s spending and product preferences as much as other age groups.

Why this matters: Gen Z’s brand preferences aren’t easily shaken by politics. Their resilience to geopolitical noise – from tariffs to trade spats – makes them a stable and valuable audience for global brands. This signals a clear imperative: strong brand equity matters more than country-of-origin cues. To win with Gen Z, brands must focus on product quality, relevance, and identity.

3. Word of Mouth Trumps Traditional Branding

In a market flooded with polished ads and big-budget campaigns, young Singaporeans are tuning them out and turning to each other – almost 6 in 10 under 30s do not pay much attention to what brands say in their ads or social media, compared to fewer than half of respondents in other age groups. In fact, nearly two-thirds of young people in Singapore are more likely to trust what others say about a brand, over what the brand says about itself.

Why this Matters: This shift in trust among younger consumers is a clear signal that brands must rethink how they build influence. Traditional advertising alone no longer cuts through. Instead, credibility must be earned through communities, peer validation, and high-quality, authentic user-generated content. With Gen Z increasingly turning to micro-influencers and online reviews, brands need to invest in voices that feel real, not rehearsed.

4. Audience Engagement has Never Mattered More

The market research landscape is shifting when it comes to Gen Z too – in surveys, they’re the most likely to get bored and distracted out of all age groups, with more than one-in-three finding unengaging questions and methodologies to be their biggest points of frustration with surveys. This could lead to poor response quality, meaning that brands risk missing out on actionable, high-quality insights from an important demographic group.

Why this Matters: This is a wake-up call for brands and researchers to rethink how they engage younger respondents. To unlock high-quality insights from Gen Z, surveys must evolve – with better design, more intuitive tone, and mobile-first formats that prioritise visuals, gamification, and conversational flow. Without this shift, brands risk losing visibility into one of the most influential consumer segments today.

5. Gen Z the Most Receptive to AI in Market Research

Gen Zs are also shaping the future of qualitative market research, with over 70% of them being open to having conversational interviews with AI-powered digital interviewers, compared to just 58% among older age groups.

Why this Matters: This openness to AI presents a clear opportunity for brands and researchers to embrace faster, more flexible, and cost-effective qualitative methods (such as Blackbox’s Dialogue platform). AI-powered interviews can unlock rich insights without the high costs of traditional research. Ignoring this shift risks defaulting to shallow, budget-driven quant approaches and missing the depth Gen Z is willing to share.

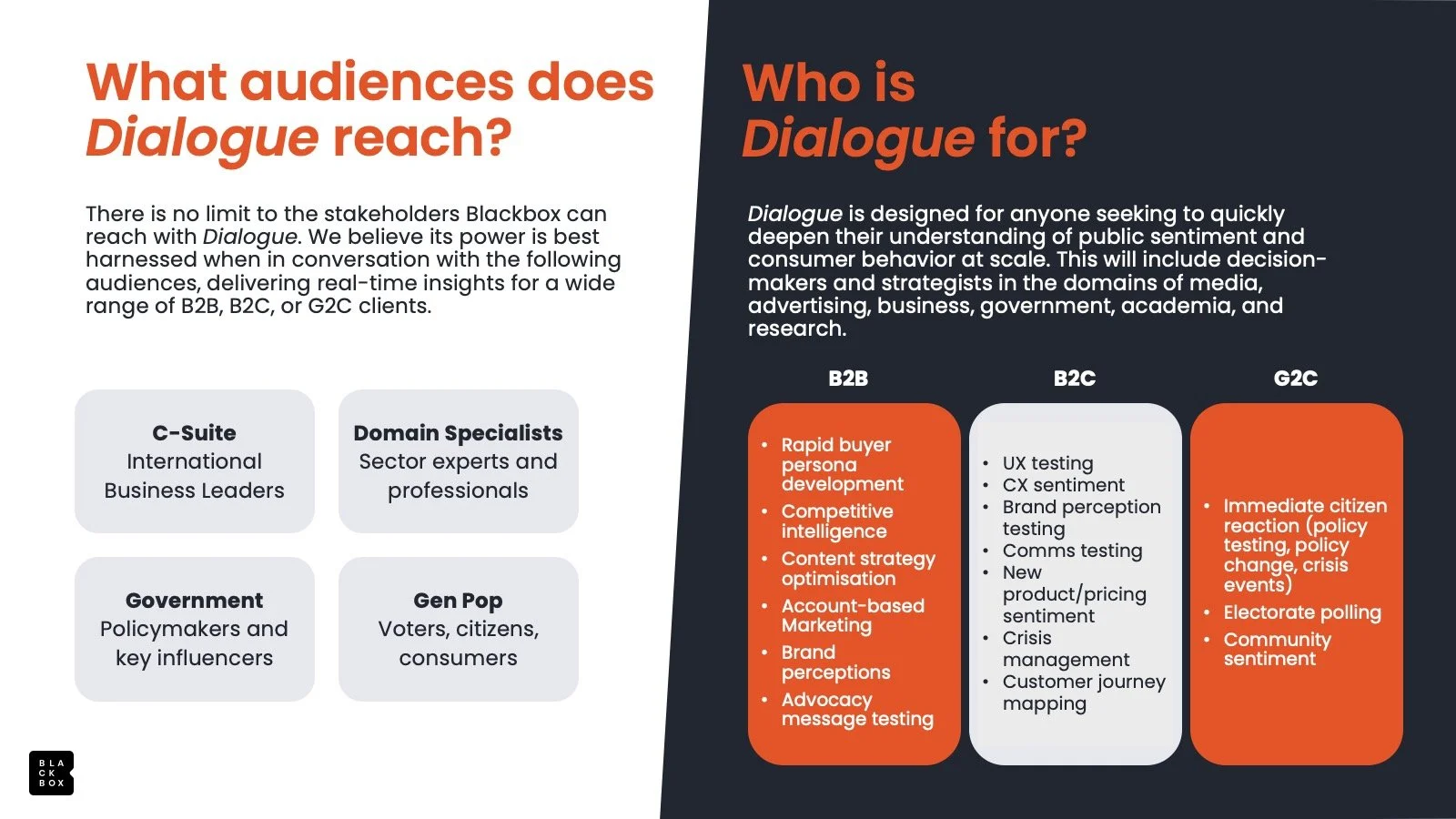

Brands can capitalise on this increased receptiveness to AI with Blackbox Dialogue — an AI powered interview tool that redefines market research by merging the natural flow of conversation with the efficiency of digital tools. Unlike traditional surveys, Dialogue engages respondents in intuitive, two-way interactions that feel more like real conversations, encouraging richer, more honest responses. It probes with the depth of a skilled interviewer but operates with the speed and scalability enabled by technology, eliminating scheduling delays. With interactive flows and voice-enabled options, it enhances the respondent experience, reducing fatigue and boosting participation, crucial to capturing Gen Z insights. Dialogue is especially effective for sensitive topics, offering the safety of anonymity while drawing out personal, unfiltered insights. In a world where consumers are increasingly comfortable with AI-driven interfaces, Blackbox Dialogue feels both familiar and future-ready—delivering deeper insights, faster and more efficiently.

Conclusion

Gen Z Singaporeans are not just the next generation of consumers, they are already shaping how brands engage, how products are marketed, and how research is conducted. Their strong optimism, trust in peer reviews, and comfort with digital tools demands a shift away from traditional strategies. For brands and researchers, this means rethinking how to build trust, communicate effectively, and gather meaningful insights. Staying relevant in this landscape means adapting to their preferences, understanding their behaviour, and meeting them where they are.

Connect With Us Today

In a world where new generations are changing the playing field and where fast insights drive competitive advantage, Blackbox Dialogue is redefining qualitative research by delivering deeper insights at scale, faster than ever before. Discover how Dialogue, paired with over 20 years of experience can transform your research approach. Reach out to us at connect@blackbox.com.sg to learn more.