Behind the Checkout: Understanding the Preferences and Patterns of Southeast Asian Consumers

In the dynamic markets of Southeast Asia, where diverse cultures intersect with rapid digitalisation, understanding the intricacies of consumer behaviour is no mean feat. So as part of our latest ASEANScan in partnership with Cint, we conducted a survey spanning six key ASEAN markets — Singapore, Malaysia, Philippines, Thailand, Vietnam, and Indonesia —to unravel the nuances of how Southeast Asians shop. With more than 3,000 respondents providing their insights, we delve into the multifaceted preferences and influencing factors shaping the region's retail landscape.

Online Is Popular but Don’t Write-Off Brick-and-Mortar

While on average, over three in five (62%) of Southeast Asians prefer online purchases across categories, a fairly substantial percentage (38%) embrace in-person, from physical local sellers. Thais and Vietnamese, at 67% each, prefer purchasing online the most while Filipinos at 51% prefer this the least. Almost half of Filipinos (48%), in fact, prefer in-person purchases.

So, while there is a comfort level with online shopping, a preference for physical stores when it comes to specific categories still exists – indicating that a harmony between the two, or at least a space for both to exist, is likely the way forward. All the naysayers who predicted doom for offline shopping were perhaps shortsighted.

Within the realm of consumer choices, however, preferences vary significantly across different product categories and purchasing channels, and while we covered several products, the top three that stood out include:

1. Personal Care and Hygiene:

A clear preference emerges, with 61% of respondents opting for online purchases while 40% favour in-person transactions from physical local sellers.

Noteworthy regional disparities surface for this category, with Indonesians showing a propensity towards online purchases from local sellers, whereas Filipinos lean towards in-person transactions.

2. Clothing and Footwear, Cosmetics, and Entertainment:

The digital tide sweeps through this category, with 84% of Southeast Asians favouring online purchases, significantly overshadowing the 29% who prefer in-person transactions. This relatively low percentage (29%) also extends to categories such as beauty/cosmetics and entertainment.

Evidently, there's a perceptible shift towards online shopping in these domains, presenting opportunities for e-commerce players to thrive. This is particularly interesting since size issues would be expected to be a factor, but with easy returns/exchanges and heavy discounts online, consumer preference is clear.

3. Jewellery:

Trust and assurance become paramount in this category, as three in five (60%) of respondents express a preference for in-person transactions from physical local sellers. In fact, nearly four in five (79%) Indonesians opt for this option, the highest in Southeast Asia.

Only 22% opt for online purchases from local sellers and 18% from international sellers, indicating a need for e-retailers to bridge the trust gap in online jewellery retail, perhaps through strong product visuals, detailed descriptions, and secure payment gateways. Singaporeans, however, are the most trusting bunch here, with over half (51%) being comfortable shopping online for Jewellery.

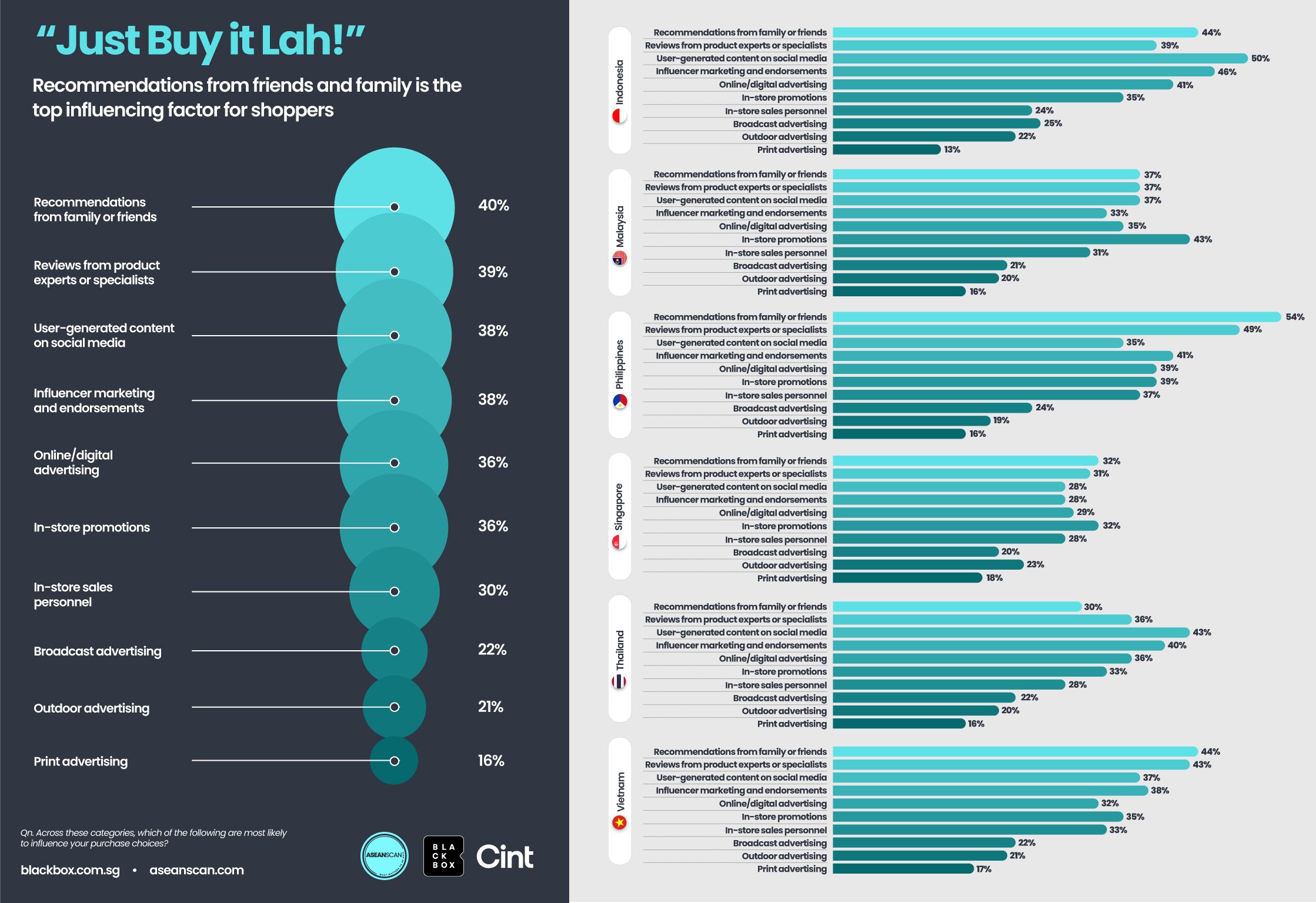

What Makes Southeast Asians Hit that Buy Button?

As consumers navigate the labyrinth of purchase decisions, various influencing factors come into play, shaping their perceptions and preferences.

1. Recommendations from Family/Friends:

Serving as pillars of trust, recommendations from personal networks consistently rank among the top influencers across categories. Perhaps obviously so – considering how close-knit Asian societies tend to be. Over half of Filipinos (54%) put their trust in this.

Brands would do well to understand the significance of these social connections in buyer behaviour.

2. User-Generated Content on Social Media and Expert Reviews:

The digital realm reigns supreme, particularly in Indonesia, where one in two (50%) say that user-generated content on platforms like Instagram, YouTube, and TikTok influence their buying decisions.

The power of authentic reviews from product experts in driving purchase intent also emerges as a key influencing factor in our study, with 39% citing it as a key influencing factor. Nearly half of Filipinos (49%) put their trust in this.

3. Influencer Marketing and Endorsements:

A potent force across Southeast Asia and perhaps the world these days, influencer marketing garners traction among consumers seeking genuine endorsements and product reviews and occupies joint-third spot in our list of factors that sway buyers. In fact, it is the number 1 influencing factor for GenZ, when it comes to categories such as clothing, footwear, entertainment, and cosmetics.

Leveraging the reach and credibility of influencers can prove instrumental in capturing the attention of discerning consumers.

Online/Digital Marketing:

With the digital landscape evolving rapidly, online marketing channels wield considerable influence in shaping consumer perceptions and purchase decisions—rounding off the top five in our list.

It is evident, then, that businesses must harness the power of social media, search engines, and other digital platforms to engage with their target audience effectively.

Implications for Businesses: Crafting Effective Marketing Strategies

Armed with insights gleaned from the survey, businesses eyeing the Southeast Asian markets can chart a course towards success by adopting tailored marketing strategies:

1. Go Local, Not Global: Don't treat Southeast Asia as a monolith. Our data shows preferences vary by country. Tailor your product offerings and marketing campaigns to resonate with local cultural nuances. For instance, the kind of influencers popular in Singapore might not resonate as well in Malaysia.

2. Double Down on E-commerce: The digital wave is unstoppable in Southeast Asia. Invest in a robust e-commerce platform that offers a seamless user experience. This includes features like easy returns/exchanges but also incorporating AI tools to help customers pick the right size, which is key for clothing and footwear. Leverage digital marketing to drive traffic to your online store.

3. Build Trust Through Authenticity: Recommendations from friends and family are hugely influential. Tap into this by encouraging user reviews and testimonials. Partner with influencers (our data shows they are the biggest hit with GenZ) who genuinely love your products to create authentic content that builds trust with potential customers.

4. Create a Seamless Shopping Journey: Your online and offline channels should work together, not compete. Run in-store promotions that complement your digital marketing campaigns. Offer click-and-collect options or easy ways for customers to research products online before visiting your physical store.

5. Transparency is King: Address consumer concerns about product quality, especially for categories like jewellery. Highlight clear product descriptions, high-quality visuals, and secure payment gateways to build trust and confidence.

In conclusion, deciphering Southeast Asian shopping habits requires a nuanced understanding of cultural intricacies, evolving consumer preferences, and the digital landscape's transformative power. By leveraging data-driven insights and embracing agile marketing strategies, businesses can navigate the diverse and dynamic markets of Southeast Asia with confidence and finesse.

Don’t miss a beat. Click the icon to follow Blackbox on LinkedIn, and fill out the form below to sign up to our newsletter or send us a message.